The third part of my critique of The Shattered Mirror: News, Democracy and Trust in the Digital Age, the Public Policy Forum’s report on the future of media, has taken longer than anticipated. In the interim, there have been some excellent posts on the report, including those from Andrew Potter, Dwayne Winseck, and Marc Edge. The first two parts of my review focused on the copyright and CBC/open licensing recommendations. This post discusses the report’s most significant financial recommendation: reforms to the Income Tax Act that would be designed to increase or capture digital advertising costs with Google and Facebook accompanied by a scheme to create a fund to support Canadian media. The recommendation is similar – though not identical – to one floated by communications law veterans Peter Miller and David Keeble in a report commissioned by the Friends of Canadian Broadcasting (FCB).

At the heart of both reports is the recommendation that advertising purchased on foreign Internet-based media should not be tax deductible. The reports offer a tempting vision for those seeking a simple solution to the struggles of Canadian media organizations. Both posit that much of the problem lies largely with the dominance of Google and Facebook in the digital advertising market. According to the FCB report:

The reason is not a failure on the part of Canadian media to transition to the internet age, or to meet Canadians’ needs. The reason, adapting the well known trade term, is the ‘dumping’ of advertising inventory into the Canadian marketplace by foreign-based internet conglomerates, which do not contribute the same level of investment, jobs and Canadian content as Canadian media.

The FCB report proceeds to try to make the legal case that these services should not qualify for advertising deductions under Canadian law, going so far as to argue that even the Google Search page should be treated like a “program” within the context of constituting “broadcasting”. According to the FCB report, these changes would dramatically change the Canadian media landscape:

For Canadian media, it could be the single greatest factor in reversing revenue declines and ensuring viability for Canadian local print, TV and radio operations – and their contributions to Canadian culture, news and democracy. Hundreds of millions of dollars could move back from foreign to Canadian owned-and-controlled media companies – stabilizing and growing their revenues, and allowing these companies to reverse job cuts and re-invest in Canadian content, including journalism.

Specifically, the suggested re-interpretation of the advertising tax deductibility provisions of the ITA would, we estimate, result in on the order of 50% – 80% of current internet advertising expenditures being deemed nondeductible. Conservatively estimating that 10% of these now non-deductible foreign internet advertising expenditures shift back to Canadian media, this would represent an influx of $250 to $450 million annually in incremental advertising revenue.

The Shattered Mirror also places great hope in the benefits of Income Tax Act reform, making it recommendation #1 and claiming that $300 to $400 million is at play. Instead of hoping that advertising will gravitate to Canadian sources, however, it envisions a ten percent withholding tax on “non-qualifying media”, which would be determined based on meeting a test for either Canadian ownership or a significant Canadian media presence that includes tax payments and meeting minimum thresholds for producing “original civic function journalism aimed primarily at Canadian audiences.” The report also recommends that the Canadian government only advertise on Canadian qualifying sites and that an exemption be created for small-scale advertisers. It estimates that the withholding tax would generate up to $400 million, which would be allocated toward a fund to support Canadian journalism.

While these reports purport to provide a much desired easy fix to the Canadian media world, the reality is unsurprisingly far more complicated. In the case of the FCB report, some of the legal arguments – Google Search and Facebook as broadcasts? – are very weak and would be unlikely to survive a court challenge.

Further, the hope that advertisers will move away from digital advertising by making it more expensive (as FCB envisions) misunderstands the very nature of advertising. Simply put, digital advertising is a function of the audience. Given that more and more people are shifting their viewing and media consumption habits from offline to digital, advertisers are unsurprisingly following their audience. A change in the tax code will not result in a shift to less effective advertising venues. Rather, it will simply make the digital advertising more expensive and leave Canadian business less competitive in the digital marketplace.

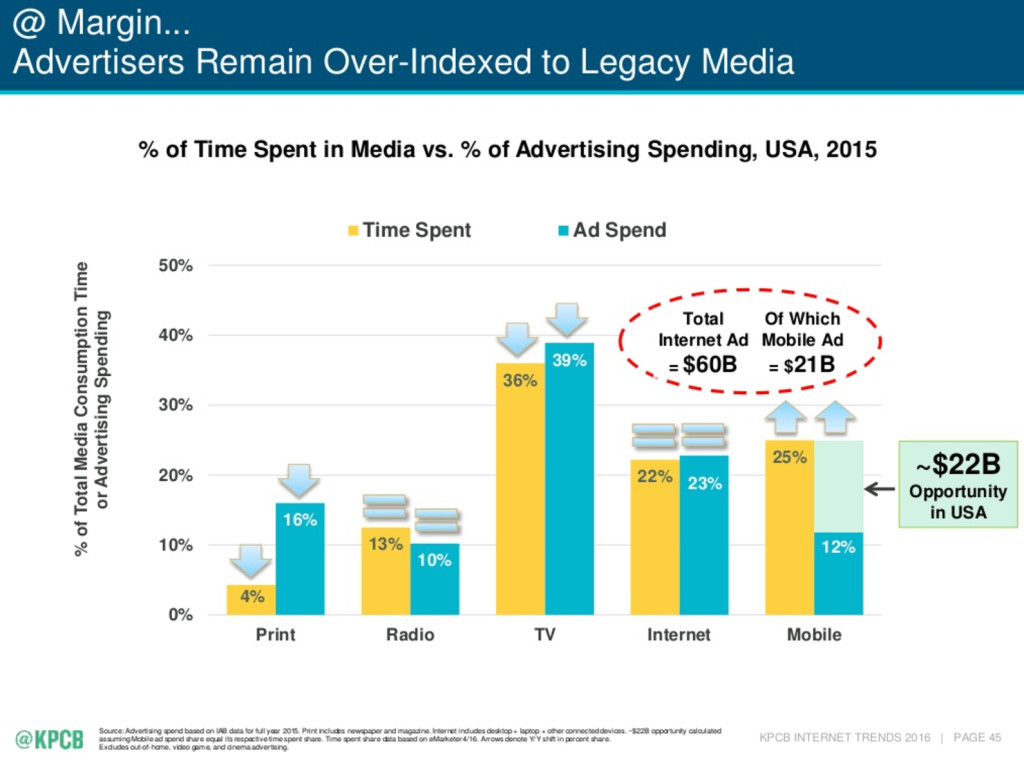

In fact, this slide from Mary Meeker, the well-known Internet analyst, provides a nice illustration of the close correlation between audience size and advertising. It suggests that these trends will continue, with newspaper advertising likely to continue its decline in favour of mobile based advertising.

Mary Meeker, KPCB Internet Trends 2016, pg. 45, http://www.kpcb.com/blog/2016-internet-trends-report

Even more problematic is how both reports miss the complexity associated with digital advertising. First, a considerable portion of digital advertising with companies such as Google involves a revenue share between Google and the site where the advertising appears. In other words, the advertising often appears on the same Canadian sites that the reports want to support. That revenue initially goes to Google, which then sends the majority back to the site or media organization. For that form of advertising, Google is simply matching advertisers and websites, while collecting a commission for providing the service. If advertising through the Google or Facebook network alone were enough to disqualify the advertising from tax deductibility, Canadian sites would be harmed in the process.

In cases where the advertising is on a foreign site – think YouTube – there may also be important Canadian connections. For example, the Globe and Mail posts videos on Youtube and generates a revenue share for the advertising that appears alongside the video. That is part of how Canadian media is trying to monetize its content, yet the policies in the reports would discourage such advertising by making it more expensive. The problem with Canadian content on foreign sites also crops up for Canadian artists and smaller media organizations, who may similarly use foreign sites as important sources of distribution and advertising revenue.

The harm extends to Canadian businesses seeking to reach larger audiences through digital advertising. As Google points out, changing the Income Tax rules would ultimately make it more difficult for small and medium sized business to reach Canadian audiences since they could not easily use existing digital ad networks.

There is a reasonable debate to be had over the dominance of Google and Facebook in the digital advertising sector and over how to fund important investigative journalism. There are some good ideas out there including levying sales taxes on digital providers, opening the door to foundational support, and creating an investigative journalism fund similar to the court challenges program. However, cutting the flow of dollars to Internet giants – particularly where that money often boomerangs back to Canada – will do little to actually help Canadian media organizations seeking to attract digital ad dollars, Canadian artists searching for new revenues online, or Canadians businesses trying to grow through digital advertising.

I work at a large organization that buys a lot of goods and services, from Canadian and foreign companies. I frequently have to explain withholding taxes to the foreign companies. Their response, and the response I would expect from companies providing advertising services is “OK, you’ll just have to pay us more then, to make up for the amount you’re required to withhold”.

I never let them get away with that, but I’m a lawyer representing an organization which buys hundreds of millions of dollars a year worth of stuff. A small Canadian business buying a few bucks worth of advertising on Google is not going to have that kind of negotiating leverage and the result will be that Canadian businesses just end up paying more for advertising.

“The reason is not a failure on the part of Canadian media to transition to the internet age, or to meet Canadians’ needs. ”

Here we are, in 2017, and we’re still dealing with a shitload of morons who haven’t yet figured out what the Internet is, but are willing to break it, in their desperate search for the necessary corporate gain to save their defeated business models.

Such people won’t be happy unless they somehow manage to turn the Internet into the same kind of “corporate broadcast system” they’re already complaining is no longer surviving.

Failure to transition to the internet age IS CERTAINLY the problem. Blaming the Internet definitely does not contain a solution . It just shows the mass ignorance that’s still out there.

follow the money… thru the means of…

production, servicing and governace.

the golden mean will prevail

LCD, HCF… Porn-tv from DND conservative flakes will norm out here.

I want the CBC to BE an ISP. rogers, bell telus et al want to filter the market for themselves. (and raise prices again, Betcha)

Given the slanted, sterilzed and sanitized productions.. the only choice is clear. (saint it)

bring back the reg that says cable HAS to uncensor and broadcast local productions.

packrat

The Cbc would be no better as of now there acting like the work for the PMO.

Pingback: Our Daily Reading List – 22/02/2017 – Blog – Clausehound

Pingback: Budget 2017: Why Canada's Digital Policy Future Is Up For Grabs - Michael Geist