The government launched its telecom/broadcast review yesterday and the discussion immediately turned to Internet and Netflix taxes. Despite the wide array of issues ranging from net neutrality to the CBC before the newly established panel, for many the focus of its recommendations and the government response will ultimately come down to whether there are new Internet regulations and taxes established to support the creation of Canadian content.

Canadian Heritage Minister Melanie Joly and Innovation, Science, and Economic Development Minister Navdeep Bains both commented on the issue, suggesting divergent priorities. Bains told the Toronto Star:

For me, a critical issue is making sure that Canadians do not pay more. This is really around quality, coverage and price, and price is something that Canadians have expressed as a concern.

Joly’s emphasis was not on consumers, but rather contributions from any service connected to the Internet, telling the Wire Report:

All players in the system must contribute. So if you’re part of the system, you have to contribute, and there’s no free ride. But that can’t be at the expense of Canadians.

I have argued that there is no need for new Internet taxes to fund Cancon as there is no Canadian content emergency. The Canadian production industry has experienced record investment in recent years, demonstrating that Joly’s initial instinct to focus on export markets and the discoverability of Canadian content was the right approach. But after facing criticism over a Netflix deal that brought hundreds of millions into the industry, Joly has been consistently inconsistent on the Internet tax message, fomenting uncertainty and lingering suspicions that the end-game is now Internet taxes and regulation.

In fairness, it should be noted that Prime Minister Justin Trudeau has been steadfast in opposing new Internet taxes. For example, when the Canadian Heritage committee recommended an Internet tax seemingly out of the blue last June in its report on local media:

The Committee recommends to expand the current 5% levy for Canadian content production on broadcasting distribution undertakings to broadband distribution.

Trudeau unequivocally rejected the recommendation an hour later while the committee was still presenting its findings at a press conference:

We respect the independence of committees and Parliament and the work and the studies they do, but allow me to be clear: We’re not raising taxes on the middle class – we’re lowering them. We’re not going to be raising taxes on the middle class through an Internet broadband tax. That is not an idea we are taking on.

Months later, the official government response explained the policy rationale for rejecting Internet taxes:

The Committee’s recommendation to generate revenue by expanding broadcast distribution levies so that they apply to broadband distribution would conflict with the principle of affordable access. The open Internet has been a powerful enabler of innovation, driving economic growth, entrepreneurship, and social change in Canada and around the world. The future prosperity of Canadians depends on access to an open Internet where Canadians have the power to freely innovate, communicate, and access the content of their choice in accordance with Canadian laws. Therefore, the Government does not intend to expand the current levy on broadcast distribution undertakings.

Despite clear messaging from the Prime Minister, for the past year Joly has sent mixed messages about Internet taxes. Her launch of Creative Canada last September assured Canadians there would be no new taxes:

When it comes to content, Canadians want choice. But we know that access and affordability of Internet and wireless are real issues for many. Broadband coverage is uneven across the country. We pay some of the highest rates in the world. Our government won’t increase the cost of these services to Canadians by imposing a new tax.

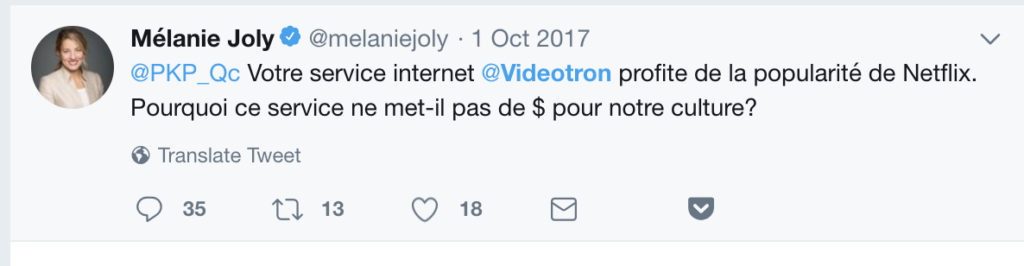

A week later, Le Devoir reported that Joly was targeting Internet providers, noting Joly’s tweet to Pierre Karl Péladeau asking why Videotron wasn’t paying cultural contributions and comments that a new system would be developed to ensure those benefiting from the Internet provide cultural funding.

Melanie Joly tweet, 1 October 2017, https://twitter.com/melaniejoly/status/914635791313272832

In February, Trudeau was asked about making “web giants pay their fair share” during Question Period in the House of Commons. His response:

We explicitly promised in the 2015 election campaign that we would not be raising taxes on Netflix. People may remember Stephen Harper’s attack ads on that. They were false. We actually moved forward in demonstrating that we were not going to raise taxes on consumers, who pay enough for their Internet at home.

Yet two days later, Joly was asked the same question, but offered a different response:

Mr. Speaker, the Prime Minister was very clear on this. We made a promise and we plan to keep it. That being said, we recognize that in the long term we need to develop a comprehensive solution for taxing digital platforms. We are not going to take a piecemeal approach.

In fact, just yesterday, Joly’s press release on the review panel included the quote “the principle guiding this review is clear: if you profit, you contribute—there is no free ride.” Hours later, a department official qualified the quote by telling Cartt.ca that “the government will reject all proposals that increase what Canadians pay.” The same tension arose during a Joly appearance at the Senate in the afternoon, where she alternately told Senators “all the players who benefit from the system, including Internet giants, must contribute. There are no free passes” and “I will also be making affordable Internet access a priority.”

When asked how to reconcile the competing goals of mandated contributions with no additional consumer costs, Joly responded to the Wire Report that “the panel will find solutions.” The panel led by Janet Yale features some of Canada’s leading experts, but they are largely lawyers, not magicians. The simple reality is that for all the talk of cost-neutral schemes, forcing Netflix to pay its share, or demanding that ISPs contribute to the system, if Joly mandates new Internet taxes, basic math suggests Internet costs will go up and Canadian consumers will ultimately foot the bill.

you need to be much clearer using “tax”. Are you talking about GST/HST? Business taxes levied on Google Facebook? A tax on ISP fees with a concurrent reduction of fees on cable access to make it revenue neutral?

Melanie Joly is wrong when she implies that ISPs, Netflix and other internet companies are getting a free ride from “the system”.

The ISPs have paid for the networks and continue to pay for maintenance of the networks. Netflix and the other internet companies have paid to develop and maintain their sites, apps and servers. Customers pay the ISPs, Netflix and other internet companies for their services.

The only ones getting a free ride from “the system” are the cultural welfare” recipients of the levy’s and taxes imposed by the CRTC.

I totally agree DB. Trying to explain networking to most politicians is a dead end though. They tend to be either willfully ignorant, or unable to use DuckDuckGo or Google to learn about it.

“…unable to use DuckDuckGo or Google…” Or Epic.

I don’t understand how the CRTC thinks it can regulate companies like Netflix that are not Canadian and don’t have physical operations in Canada. The fact that millions of Canadians watch it does not mean that the CRTC has jurisdiction. Millions of Canadians watch the US TV networks and the CRTC can’t regulate them. So what gives it authority over Netflix and what would it do if Netflix refused to comply with any of the CRTC’s regulations? Would the CRTC tell the ISPs to block Netflix?

And do tell why shouldn’t Facebook & Google not collect HST on their Canadian advertising? And why shouldn’t Facebook & Google not have to pay revenue taxes.

CraveTV has to charge HST on the service they offer, why shouldn’t Netflix? Why should Netflix get a competitive edge?

Ride sharing companies don’t collect HST, again saying they don’t provide services in Canada

Nobody wants to pay more for anything, but Google, Facebook, etc. shouldn’t be allowed to have a competitive advantage over companies that support Canadian jobs & industries.

I don’t understand why American companies who target Canada, yet claim “they don’t business here” should be defended.

First of all the crtc has nothing to do with hst. They are talking about new fees that would go into a pool that would then fund some Canadian productions.

Under Canadian law foreign nonresident companies do not have to charge and collect hst. Canadian companies and individuals that purchase goods or services from a foreign company are required to self assess. That means they are required to calculate the hst on the goods or services and remit it to the government. Most companies comply, most individuals don’t. That means hst is collected on most of the ads on Google and Facebook and not collected on Netflix.

The issue is much broader than just getting Google or Netflix to collect hst. The law has to work for any foreign company that sells and ships goods to Canada and for any Canadian company that sells to foreign markets. C

Guess what people, everyone pays tax except Google and Facebook and Netflix. Sure they’re offshore, that’s the business plan. They aren’t anywhere, so they don’t pay tax anywhere. But they do business with Canadians, via Canadian infrastructure. They’re rolling in money. Let’s soak some of it up for the common weal.

Sounds good. But the only way I can see to achieve that in a fair way would be something like transfer payments between governments, otherwise that money will come from you and I – which seems like the plan that some people are promoting. I think you’re forgetting that the infrastructure is mostly not actually Canadian. The internet is a distributed network and most of the infrastructure used by all of us, and particularly Google, Facebook and Netflix, is not actually physically in Canada nor owned by Canadians.

I was referring to the Canadian telecom infrastructure.

My guess is you don’t do traceroutes very often.

What an asinine comment.

Interesting comment in the comments section to Geist’s op-ed in the Globe and Mail:

Not the best Geist article. First statistical evidence is 75% of wireless traffic is not video or audio – hmmm, did we forget that wireless isn’t the only way to connect to the internet and is not the way Netflix gets into the house. Leaving out an inconvenient statistic that doesn’t support the headline means the whole thing becomes an agenda driven partisan opinion. Geist, as an academic, would never accept such a flawed argument from a student, why should anyone accept it from him?

This latter point I’ve made repeatedly. All kinds of people call Geist out regularly for bending the facts. On a simple level, as a very highly paid civil servant (that’s what a university professor is), he shouldn’t be making these mistakes, especially when they appear wilful and deliberate. Would you be happy if your doctor was misdiagnosing your condition because of faulty knowledge, or worse yet a deliberate that ran against the facts of your condition? Or to take a simpler example, a bureaucrat at the planning department misinforming you about the building code when you build a house? Because they don’t like your house design?

Second, and once again because Geist is both an academic and a civil servant, each with high standards of rectitude and each demanding a degree of fairness and impartiality, as a public policy analyst and self-appointed expert working on a very lavish public dime (couple of hundred grand a year in salary, plus outside consulting, speaking fees, etc.), Geist has an obligation to the public to present a more balanced analysis of public policy than his constant one-sided lobbying for various agendas. It’s shameful really.

http://proxy8080socks5socks4.ru/

Pingback: Government Memo Suggests Netflix Outspends Canadian Private Broadcasters on Canadian English Scripted Programming - Michael Geist

Why the income tax is not enough. More income from whatever the sources gets more tax. Does it sound simple? Jasa Periklanan