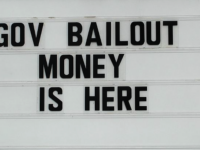

The government has taken the first step to creating a bailout for its disastrous Bill C-18 by agreeing to News Media Canada demands to increase the support under the Labour Journalism Tax Credit. While the current system covers 25% of the journalist costs up to $55,000 per employee (or $13,750), the government’s fall economic statement increases both the percentage covered and cap per employee. Under the new system, which is retroactive to the start of this year, Qualified Canadian Journalism Organizations (which covers print and digital but not broadcasters) can now claim 35% of the costs of journalist expenditures up to $85,000 per employee. The increases the support to up to $29,750 per employee or an increase of 116%. This new support will run for four years at a cost of $129 million ($60 million this year alone).

Archive for November 21st, 2023

Law Bytes

Episode 231: Sara Bannerman on How Canadian Political Parties Maximize Voter Data Collection and Minimize Privacy Safeguards

byMichael Geist

March 31, 2025

Michael Geist

March 24, 2025

Michael Geist

March 10, 2025

Michael Geist

Search Results placeholder

Recent Posts

The Law Bytes Podcast, Episode 231: Sara Bannerman on How Canadian Political Parties Maximize Voter Data Collection and Minimize Privacy Safeguards

The Law Bytes Podcast, Episode 231: Sara Bannerman on How Canadian Political Parties Maximize Voter Data Collection and Minimize Privacy Safeguards  The Law Bytes Podcast, Episode 230: Aengus Bridgman on the 2025 Federal Election, Social Media Platforms, and Misinformation

The Law Bytes Podcast, Episode 230: Aengus Bridgman on the 2025 Federal Election, Social Media Platforms, and Misinformation  The Law Bytes Podcast, Episode 229: My Digital Access Day Keynote – Assessing the Canadian Digital Policy Record

The Law Bytes Podcast, Episode 229: My Digital Access Day Keynote – Assessing the Canadian Digital Policy Record  Queen’s University Trustees Reject Divestment Efforts Emphasizing the Importance of Institutional Neutrality

Queen’s University Trustees Reject Divestment Efforts Emphasizing the Importance of Institutional Neutrality  The Law Bytes Podcast, Episode 228: Kumanan Wilson on Why Canadian Health Data Requires Stronger Privacy Protection in the Trump Era

The Law Bytes Podcast, Episode 228: Kumanan Wilson on Why Canadian Health Data Requires Stronger Privacy Protection in the Trump Era